Bienvenue sur le site de EAVEST

Ce site Internet est réservé à l’usage d’utilisateurs professionnels.

Welcome to EAVEST

This website is strictly reserved for the use of professionals only.

Structured products are the only financial instruments to precisely shape an investment solution according to the risk profile and market anticipation of each investor.

EAVEST helps you develop tailored products which allow you to implement your investment strategies.

Not only do you determine the risk / return ratio and the investment period, but you also have a choice of underlying assets such as equities stock indexes, bonds, commodities, or currencies. These structured products are customised to meet specific requirements and market forecasts, to the highest level of detail.

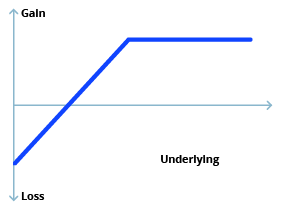

Your clients’ tolerance for risk is low to moderate. They might be, for example, searching for an alternative to a bond investment that protects capital while providing a more attractive return potential than a regular risk free return.

If your clients realise their market expectations, they will receive a higher return than a bond, for example.

This class includes a series of different products. Their one similarity is the reimbursement of a minimum defined amount at maturity, in general between 90 and 100% of the invested capital. They also have an element of return whose structure may differ between products. EAVEST offers capital protection products covering almost all asset classes.

The risks of product offering capital protection are comparatively reduced. Two aspects are important: Firstly, the product only provides capital protection as at the maturity date. Therefore, if your clients need to sell the product because they need the invested capital before its maturity, a loss is possible. Secondly, in order to reduce the risk, it is important to select a high quality issuer.

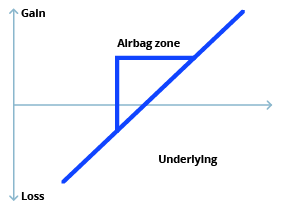

Your clients’ tolerance for risk is moderate to high and they anticipate zero or very small markets’ increase in the near future. They are searching therefore for investment opportunities which can still produce attractive yields.

If an underlying asset, such as an equity stock,perfoms as anticipated, i.e does not progress in value, this investment is clearly more profitable than the direct investment itself.

The principle underlying the optimization products is that your clients benefit from a fixed coupon with which they realize attractive returns as long as the base value changes within the expected range. In return, they reduce their potential gains if markets perform better than expected, that is to say, if the markets are very bullish. EAVEST offers a range of products with a wide range of underlying assets.

These products have ultimately the same risk as their underlying asset, even if the risk of loss is reduced through a coupon. We should underline that your gains may vanish if, against all expectations, the underlying asset value sharply declines.

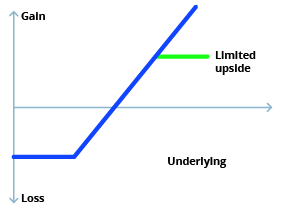

Your clients’ tolerance for risk is medium to high and they want a simple investment strategy, which allows them to benefit and diversify in certain markets that they do not normally have access to, while managing their risks as appropriate.

Your clients can fully benefit from changes in the underlying value, or in a particular market.

These products, often called Delta 1 or Certificates, are the most transparent: the investor is usually fully exposed to the evolution of the underlying value. This family of multifaceted products is suitable for long-term wealth accumulation. Particular versions of these products also provide some capital protection.

The risk is that of the underlying value. For some investment solutions, it may be possible to protect against losses in value.